About Class 10 Economics Notes: Money and Credit

The chapter Money and Credit explains how money plays a vital role in modern economies. Earlier, people exchanged goods through the barter system, but it had limitations like a lack of a common measure of value and difficulty in exchange. Class 10 Money solved these problems by acting as a medium of exchange, a unit of value, and a store of wealth. The class 10 social Science Economics chapter also discusses formal and informal credit sources. Formal sources include banks and cooperatives, which lend money at low interest rates and are regulated by law. Informal sources, like local moneylenders, charge high interest and often exploit borrowers. Students learn about the importance of expanding formal credit facilities to rural areas so that farmers and small businesses can avoid falling into debt traps.

The notes highlight the role of the Reserve Bank of India (RBI) in regulating credit and ensuring financial stability. It sets interest rates, monitors the flow of money, and maintains trust in the financial system. Understanding terms like collateral, loan, credit, and debt cycle helps students prepare well for exams. These Class 10 notes emphasize that credit, when used productively, can improve lives. However, if misused or charged at high rates, it can lead to poverty.

.png)

Problems Created by The Barter System

- Barter system was a system of exchange that was prevalent before the use of money in ancient and medieval period.

- It was a system in which good was exchange with other good. There was no common medium of exchange.

- This created many problems which can be illustrated by an example.

- Take the case of a shoe manufacturer. He wants to sell shoes in the market and buy wheat.

- Imagine how much more difficult it would be if the shoe manufacturer had to directly exchange shoes for wheat without the use of money.

- He would have to look for a wheat growing farmer who not only wants to sell wheat but also want to buy the shoes in exchange.

- That is, both parties have to agree to sell and buy each other’s commodities.

- This is known as double coincidence of wants. What a person desires to sell is exactly what the other wishes the need for double coincidence to buy.

- In a barter system where good are directly exchanged without the use of money, double coincidence of wants is an essential feature.

Importance of Money

A person holding money can easily exchange it for any commodity or service that he or she might want. Everyone prefers to receive payments in money and then exchange the money for things that they want.

- Double Coincidence Of Wants:

Double coincidence of wants mean both parties i.e., the buyer and the seller have to agree to sell and buy each others commodities.

In a barter system where goods are directly exchanged without the use of money, double coincidence of want is an essential feature. In an economy where money is in use, money by providing the crucial intermediate step eliminates the need for double coincidence of wants.

- Money As Medium Of Exchange:

Since money acts as an intermediate in the exchange process, it is called a medium of exchange.

- Medium of exchange is an important function of money. It means that money acts as an intermediary for the goods and services in an exchange of transaction. Use of money as a medium of exchange has removed the major difficulty of double coincidence of wants in the barter system.

- The medium of exchange, function of money has classified all transactions on the basis of time and place. Now, the seller of goods need not sell his goods at a particular time and place and buy goods of the same value as well.

- The 'medium of exchange' function of money implies that money is generally acceptable by the people. They can buy goods and services they need using money. That is, money facilitates multilateral trade.

- Money also offers economic freedom to the people.

Role of Money In An Economy:

- Money plays an important role in the economy of a country. The use of money is at every step of life. In fact it would be hard to imagine life without money.

- The main function of money in an economic system is to facilitate the exchange of goods and services, i.e., to lessen the time and effect required to carry on trade.

- Without exchange of goods and services nobody can fulfill all his needs and requirements. Without money, exchange is not easy. Barter system has many problems.

- We are living in world, with a very large group of countries and their population. As the group becomes larger and larger, problems begin to emerge more and more with the barter system.

- Modern economies are highly specialized. There is specialization of firms, of business, of regions, of types of capital, etc. Such specialization allows the utilization of each person at the best of his or her ability and skill, each region to the maximum advantage, and the use of large amounts of specialized capital to reap economics of scale. The fruits of this are high standards of living and productivity. All this specialization will not be possible without an equal highly developed system of exchange and trade, i.e., the use of money

- Money serves the economy of the country performing the following four most important functions:

- A unit of value

- medium of exchange

- A standard deferred payments and

- store of value.

Modern Forms Of Money

- Money is something that can act as a medium of exchange in transactions.

- Before the introduction of coins, a variety of objects was used as money.

- For example, since the very early ages, Indians used grains and cattle as money.

- Thereafter came the use metallic coins – gold, silver, copper coins – a phase which continued well into the last century.

Why Currency Is Accepted As A Medium Of Exchange?

(i) It is accepted as a medium of exchange because the currency is authorized by the government of the country.

(ii) The law legalizes the use of rupee as a medium of payment that cannot be refused in settling transactions in India. No individual in India can legally refuse a payment made in rupees.

Monetary System Adopted By India:

(i) India has adopted paper currency standard which is also referred as the managed currency standard.

(ii) The monetary standard means the types of standard money used and the standard refers to legal money in which the government discharges its obligations. The monetary standard is thus synonymous with the standard money adopted. Thus in India paper currency is the unlimited legal tender i.e., it is used to settle debts and make payments to an unlimited amount.

(iii) Reserve Bank of India issues all currency notes and coins except one rupee notes and coins which are issued by ministry of finance.

(iv) The system governing note issue is the minimum reserve system which means that we have kept a reserve of 200 crore and the Central Bank is permitted to issue notes to any extent.

Do Check - Sectors of the Indian Economy

Deposits With Banks:

- The other form in which people hold money is as deposits with banks.

- At a point of time, people need only some currency for their day-to-day needs.

- The extra cash available with the people is deposited in the bank account in their names.

- Banks accept the deposits and also pay an interest rate on the deposits.

- In this way people’s money is safe with the banks and it earns an interest.

- People also have the provision to withdraw the money as and when they require.

- Since the deposits in the bank accounts can be withdrawn on demand, these deposits are called demand deposits.

- Demand deposits offer another interesting facility. It is this facility which lends it the essential characteristics of money (that of a medium of exchange).

Cheque And Its Advantages:

Demand deposits offer another interesting facility. Any person who has an account with the bank can make his payments through cheques. A cheque is a paper instructing the bank to pay a specific amount from the person's account to the person in whose name the cheque has been made.

.png)

(i) It is the safest mode of transactions.

(ii) It is easy to carry a cheque as compare to money.

(iii) The facility of cheques against demand deposits makes it possible to directly settle payments without the use of cash.

.png)

Role The Banks Play In The Economy Of A Country:

The banks play an important role in the economy of a country

- They keep the money of the people in safe custody otherwise people can become an easy prey of thieves or robber.

- They give interest on the money deposited by the people. Thus they add to the income of the depositor. Many families survive on the bank interest.

- The banks mediate between those who have surplus money and those who need money.

- Banks provide cheap loans to a large number of people.

- Banks promote agriculture by providing loans to the farmers who can increase their production by bringing new farm implements and make better arrangements for the irrigation of their fields without which they cannot survive.

- The banks are the backbone of the country's trade also.

- Banks employ a large number of people and as such they solve the employment problem also.

Central Bank:

Banks boost the country's industry also by providing cheap loans to the industrialists etc.

Is an apex institution in the banking and financial structure of a country. It plays a leading role in controlling, regulating, supervising and developing the banking and financial structure of the economy.

Function of a central bank

(i) It issues the currency notes

(ii) It acts as a banker to the government.

(iii) Central bank acts as a banker of banks.

(iv) Central bank also functions as the custodian of foreign exchange reserve of a country.

(v) It controls credit.

(vi) It also performs developmental and promotional functions.

(vii) It maintains relation with the international organizations such as the World Bank, IMF, etc.

(viii) It conducts research studies and surveys and publishes reports.

(ix) It formulates an appropriate monetary policy for the country.

(x) It provides training facilities to the staff working in a various banking institutions in the country.

Do Check - Globalisation and Indian Economy

Commercial Banks:

A banking company is one which transacts the business of banking which means accepting deposits for the purpose of Indian companies lending or investment, deposits of money from the public, repayable on demand or otherwise withdrawable by cheque, draft etc. Commercial banks are also called joint stock banks because they are organized in the same manner as joint stock companies.

Main features of commercial banks are:

- It deals with money; it accepts deposits and advances loans.

- It also deals with credit. It has the power to create credit.

- It is a commercial institution, whose aim is to earn profit.

- It is a unique financial institution that creates demand.

- It deals with the general public.

Loan Activities Of Banks

- What do the banks do with the deposits which they accept form the public?

- Banks keep only a small proportion of their deposits as cash with themselves.

- For example, banks in India these days hold about 15 per cent of their deposits as cash.

- This is kept as provision to pay the depositors who might come to withdraw money from the bank on any given day.

- Since, on any particular day, only some of its many depositors who might come to withdraw cash, the bank is able to manage with this cash.

- Banks use the major portion of the deposits to extend loans.

- There is a huge demand for loans for various economic activities.

- Banks make use of the deposits to meet the loan requirements of the people.

- In this way, banks mediate between those who have surplus funds (the depositors) and those who are in need of these funds. (Investors)

- Banks charge a higher interest rate on loans than what they offer on deposits.

- The difference between what is charged from borrowers and what is paid to depositors is their main source of income.

CREDIT

Credit (loan) refers to an agreement in which the lender supplies the borrower with money, goods or services in return for the promise of future payment.

Two Different Credit Situations:

(i) During the situation of a sudden demand, the producers obtain credit to meet the working capital needs for production. The credit helps him to meet the ongoing expenses of production on time, and thereby increases his earning. Credit therefore plays a vital and positive role in this situation.

(ii) In rural areas the main demand for credit is for crop cultivation. Farmers usually take crop loans at the beginning of the season and repaythe loan after harvest. Repayment of the loan is crucially dependent on the income from farming. The failure of the crop makes the loan repayment impossible. Credit instead helping them in improving their earnings, left those worse off. This is an example of what is commonly called debt-trap. Credit in this case pushes the borrower into a situation from which recovery is very painful.

Role Of Credit For Development:

(i) It plays a major role in the development of a country by creating better facilities for agricultural and industrial activities.

(ii) Moreover, it helps people from all walks of life insetting up their business, increase their earnings and support their families.

(iii) To some people, loans help a lot in constructing their houses and get rid of monthly rents.

(iv) To others, loans or credit help a lot in raising their social status by enabling them to buy cars, scooters, televisions etc.

Swapna’s Problem:

Swapna, a small farmer, grows groundnut on her three acres of land. She takes a loan from the moneylender to meet the expenses of cultivation, hoping that her harvest would help repay the loan. Midway through the season the crop is hit by pests and the crop fails. Though Swapna sprays her crops with expensive pesticides, it makes little difference. She is unable to repay the moneylender and the debt grows over the year into a large amount. Next year, Swapna takes a fresh loan for cultivation. It is a normal crop this year. But the earnings are not enough to cover the old loan. She is caught in debt. She has to sell a part of the land to pay off the debt.

.png)

Terms of CREDIT:

Interest rate, collateral and documentation requirement, and the mode of repayment together comprise what is called the terms of credit. The terms of credit vary substantially from one credit arrangement to another. They may vary depending on the nature of the lender and the borrower,

Collateral:

Is an asset that the borrower owns (such as land, building, vehicle, livestock, deposits with banks) and uses this as a guarantee to a lender until the loan is repaid? If the borrower fails to repay the loan, the lender has the right to sell the asset or collateral to obtain payment. Property such as land titles, deposits with banks, livestock are some common examples of collateral used for borrowing.

Loans From Cooperatives:

Besides banks, the other major sources of cheap credit in rural areas are the cooperative societies (or cooperatives). Members of a cooperative pool their resources for cooperation in certain areas. There are several types of cooperatives possible such as farmers cooperatives, weavers cooperatives, industrial workers cooperatives, etc. Krishak Cooperative functions in a village not very far away from Sonpur. It has 2300 farmers as members. It accepts deposits from its members. With these depositions as collateral, the Cooperative has obtained a large loan from the bank. These funds are used to provide loans to members. Once these loans are repaid, another round of lending can take place.

Krishak Cooperative provides loans for the purchase of agricultural implements, loans for cultivation and agricultural trade, fishery loans, loans for construction of house and for a variety of other expenses.

Must check - Consumer Rights

Formal And Informal Sector Credit In India

The various types of loan can be conveniently grouped as formal sector loans and informal sector loans

Formal Sector:

- Among the formal sectors are loans from banks and cooperatives.

- The Reserve Banks of India supervises the functioning of formal sources of loans.

- For instance, we have seen that the banks maintain a minimum cash balance out of the deposits they receive.

- The RBI monitors the banks in actually maintaining cash balance.

- Similarly, the RBI sees that the banks give loans not just to profit-making businesses and traders but also to small cultivators.

.png)

- Small scale industries, to small borrowers etc.

- Periodically, banks have to submit information to the RBI on how much they are lending, to whom, at what interest rate, etc.

- This sector changes very low rate of interest.

Informal Sector:

- There is no organization which supervises the credit activities of lenders in the informal sector.

- They can lend at whatever interest rate they choose. There is no one to stop them from using unfair means to get their money back.

- Compared to the formal lenders, most of the informal lenders charge a much higher interest on loans.

- Thus, the cost of the borrower of informal loans is much higher.

- Higher cost of borrowing means a larger part of the earnings of the borrowers is used to repay the loan. Hence, borrowers have less income left for themselves.

- In certain cases, the high interest rate of borrowing can mean that the amount to be repaid is greater than the income of the borrower.

- This could lead to increasing debt and debt trap.

- For these reasons, banks and cooperative societies need to lend more.

- This would lead to higher incomes and many people could then borrow cheaply for a variety of needs.

- They could grow crops, do business, set up small-scale industries etc.

- They could set up new industries or trade in goods. Cheap and affordable credit is crucial for the country’s development.

Formal And Informal Credit: Who Gets What?

- The people are divided into four groups, from poor to rich.

- 85 per cent of the loans taken by poor households in the urban areas are from informal sources.

.png)

- Compare this with the rich urban households.

- Only 10 per cent of their loans are from informal sources, while 90 per cent are from formal sources.

- A similar pattern is also found in rural areas.

- The rich households are availing cheap credit from formal lenders whereas the poor households have to pay a heavy price for borrowing.

- First, the formal sector still meets only about half of the total credit needs of the rural people.

- The remaining credit needs are met from informal sources. Most loans from informal lenders carry a very high interest rate and do little to increase the income of the borrowers.

- Thus, it is necessary that banks and cooperatives increase their lending particularly in the rural area, so that the dependence on informal sources of credit reduces.

- Secondly, while formal sector loans need to expand, it is also necessary that everyone receives these loans.

- At present, it is the richer households who receive formal credit whereas the poor have to depend the informal sources.

Self-Help Group For The Poor:

- Atypical self help group can have 15 to 20 members usually belonging to the same village.

- The main motive of self help group is to pool the savings of the poor people.

- Saving per member can vary from Rs. 25 to Rs. 100 or more depending on the ability of the people and the strength of the group.

- The self help groups provide loans to their members at a reasonable rate.

- After a year or two, if the group is regular in savings, it becomes eligible for bank loans.

- Loan is sanctioned in the name of the group with the main motive to create self employment opportunities for the members.

- In the recent years, many commercial and cooperative banks have provided loan to these self help groups for releasing mortgaged land, for meeting working capital needs, for housing materials, for acquiring assets like sewing machines, handlooms, cattle etc.

- Most of the self help groups work in a democratic way i.e., it is the group which decides regarding the loans to be granted, interest to be charged, schedule etc.

- A case of non-repayment of loan by any member is followed up seriously by other members in the group and because of this feature the commercial banks don't hesitate to lend loans to these groups.

- The most important feature of self help groups is that most of these groups are being organized by women. These are helping women to become financially self reliant. The regular meetings of the group provide a platform to discuss and act on a variety of social issues such as health, dowry, domestic violence, child marriage etc.

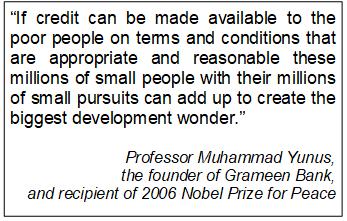

Grameen Bank Of Bangladesh

Grameen Bank of Bangladesh is one of the biggest success stories in reaching the poor to meet their credit needs at reasonable rates. Started in the 1970s as a small project, Grameen Bank now has over 6 million borrowers in about 40,000 villages spread across Bangladesh. Almost all of the borrowers are women and belong to poorest sections of the society. These borrowers have proved that not only are poor women reliable borrowers, but that they can start and run a variety of small income-generating activities successfully.

Important Terms

- Money: Money may be defined as anything which is generally accepted by the people in exchange of goods and services or in repayment of debts. According to Crowther, “Money can be defined as anything that is generally accepted as a means of exchange and at the same time acts as a measure and as a store of value.”

- Barter exchange/Barter system: It implies direct exchange of goods against goods without use of money is called barter exchange. It is also called C.C. economy, i.e., commodity for commodity exchange economy. When a weaver gives cloth to the farmer in return for getting wheat from that farmer, this is called barter exchange.

- Money as Legal tender money: Currency (coins and notes) is bound to accept is it in exchange for goods and services and in discharge of debts. None can refuse to accept it because non-acceptance is an offence. It is issued by the government or duly authorized Central Bank.

- Demand Deposits: Deposits in a bank which are payable on demand are called demand deposits. It also provides the facility of medium of exchange which is a function of money, when payments are made by cheques.

- Cheque: It is a paper instructing the bank to pay a specific amount from the person’s account to the person in whose name the cheque has been made.

- Loan activities of banks: Basically banks borrow money to lend. Banks pay interest (suppose x%) from whom it borrows. After keeping a portion of deposits as reserves, banks lend to people who demand money as loan and bank charges interest (suppose y%) from them. The difference between what is changed from borrowers (y%) and what is paid to depositors is their main sources of income.

- Credit (loan): Credit refers to an agreement in which the lender supplies the borrower with money, goods or services in return for the promise of future payment. Main demand for credit is for crop production in case of rural areas.

- Debt-trap: Suppose a person takes a loan and due to unavoidable circumstances he is not able to repay his loan. Now he faces a difficult situation and has to take a loan to repay the previous loan. This situation is called debt-trap.

Key Points

- The use of money spans a very large part of our everyday life.

- In many transactions, goods are being bought and sold with the use of money.

- For some, there might not be any actual transfer of money taking place now but a promise to pay money later.

- A person holding money can easily exchange it for any commodity or service that he or she might want.

- Thus everyone prefers to receive payments in money and then exchange the money for things that they want.

Must check - NCERT Solutions for Class 10

Class 10 Economics Notes Chapter-Money and Credit Solved Questions with Answer

- What do you understand by the double coincidence of wants? Give two examples.

Sol: When both the parties agree to sell and buy each others commodities, it is called double coincidence. A farmer had wheat to sell and needs clothes. Then he has to find a person how has clothes to sell and is in need of wheat.

- How does money solve the problem of double coincidence of wants?

Sol. In an economy where money is in use, it provides the important intermediate step and eliminates the need for double coincidence.

- Define “Barter” system exchange by giving two examples.

Sol. In a barter system goods are directly exchange without the use of money. Double coincidence of wants is essential. e.g. you exchange your surplus with the needed by another.

- What is the modern form of currency? How it help in exchange of goods and satisfying our needs?

Sol. Modern forms of currency are note and coins. When we need any article, we give money and get that thing in exchange. Thus we satisfy our needs.

- Who issues Currency Notes?

Sol. Reserve Bank of India on behalf of Government of India.

- What are the benefits of putting cash in the Bank?

Sol. When we put extra cash with us in the bank, it is safe and can be withdrawn other needed and bank also pays interest.

- Cheap and affordable credit is crucial for the country’s development. Explain.

Sol. Villagers often need money, Lala, Mahajan charge heavy interest. If there is a Bank or Society they can get loan by paying small interest and repay in installments

- What do you understand by Formal Sector Loans and Informal Sector Loans? Give two examples of each.

Sol. Formal Sector Loans are those loans which are obtained from Govt. Agencies e.g. (a) Loans from banks. (b) Loans from Cooperative Societies. Rate of interest is low.

Informal Sector Loans are those on which Government has no control e.g. money lenders, Mahajans, traders and employers. Rate of interest is high.

- How does money make it cashier to exchange goods and services? Why is it called medium of exchange?

Sol. (i) Money is a medium of exchange which is universally acceptable and therefore it makes exchange of commodities easy. In case of money there is no need of double co-incidence of wants.

Wheat ® Money ® Clothes

(ii) When money acts as intermediate in the exchange process, it is called medium of exchange every producer sells his goods and services and gets money and then with that money he can buy anything he wants and thus it becomes medium of exchange.

- Why paper money is accepted as medium of exchange?

Sol. (i) It is accepted as medium of exchange because the currency is authorized by the government of the country.

(ii) In India, Reserve Bank of India issues currency notes on behalf of the central government. It is hence the law which legalize money as medium of payment.

- Why are demand deposits considered as money?

Sol. (i) Demand deposits refers to money on current account i.e. a bank deposit can be withdrawn with out notice.

(ii) Demand deposits act as medium of exchange when payment is made through cheque instead of cash.

(iii) Since demand deposits are accepted widely as a means of payment they constitute money in the modern economy.

- How does crop failure make life worse for farmers in rural areas?

Sol. (i) In rural areas farmers take loan for crop production and repayment is made through sale of crop.

(ii) If there is crop failure it makes loan repayment impossible for repayment of loan.

(iii) Farmers have to sell part of the land. Thus credit, instead of making farmer better off, makers them poorer than before. Credit puts farmers into debt trap if crop fails.

- In what ways does the Reserve Bank of India supervise the functioning of bank? Why is this necessary?

Sol. Reserve Bank of India supervises the functioning of banks in many ways, for instance:

(i) RBI monitors that banks give loans to people not for profit but to help them when they need it.

(ii) RBI monitors bank’s cash flow as to how much they are lending and at what rate of interest etc.

(iii) RBI sees to it that funds are not missed by the banks.

- What are the Inconveniences of Barter Exchange?

Sol. (i) Lack of double coincidence of wants.

(ii) Absence of common measure of values.

(iii) Lack of divisibility.

(iv) Difficulty in storing wealth.

(v) Lack of satisfactory unit to engage in contracts.

- What are the Functions of Money

Sol. (i) Medium of exchange

(ii) Measure of value

(iii) Standard of demand payments

(iv) Store of value

- Why doe we need expand formal sources of credit in India?

Sol. Formal sources of credit include banks and co-operatives. though credit coming form the formal sources is rising steadily. A lot needs to be done to expand formal sources for the following reasons –

(i) Formal sources are less risky and don’t use unfair means to get their money back.

(ii) Formal sources change less rate of interest.

(iii) The credit activities of the formal sources are supervised by RBI whereas no supervision is done for informal sources (money-lender).

- Mention any two terms of credit laid down by banks?

Sol. Before banks give credit to people, they have to fulfill certain terms or conditions as follows:

(i) Creditor has to agree to pay the rate of interest fixed by the bank.

(ii) Borrower has to guarantee on asset as collateral.

(iii) Mode of payment is agreed upon in advance.

(iv) There is a requirement of documentation.

- Why credit is important for development”

Sol. Availability of credit is very important for development for the following reason:

(i) In India majority of people who are into production i.e. farmers, owners of cottage and small scale industries are very poor. They don’t have their own money to invest in the production projects.

(ii) Farmers in order to increase their production need credit to buy HYV of seeds, fertilizers, pesticides, irrigation facilities etc.

(iii) People in order to set up business, small scale industry, cottage industry need loans to buy raw material, machines etc.

- What are ‘Self Help Groups’ (SHGs)? How do they solve the problem of credit in rural areas?

Sol: (i) SHGs are small groups of 15 – 20 members who save money and pool together. Members of the group can take small loans to meet their short term, small needs.

(ii) They change interest on these loans which is very less.

(iii) To get loans there is no need of collateral.

(iv) People can not only take loans for production that also for personal needs as well.

(v) SHGs also gets loans from banks even without collateral.

Do Check - CBSE Class 10 Syllabus

Class 10 Economics Notes Chapter-Money and Credit Exercise – 1

- Who issues coins in India?

(a) R.B.I. (b) Central govt.

(c) State govt. (d) Governor

- How issues currency votes

(a) R.B.I. (b) Central govt.

(c) State govt. (d) Governor

- Usually Bank deep - % of total deposit or cash

(a) 10% (b) 15%

(c) 20% (d) 5%

- Check can be issued by a person who

(a) has his account in the bank

(b) may or may not has his account in the bank

(c) has credit card

(d) all the above

- Documents required for credit and the mode of repayment is called

(a) collateral (b) terms of credit

(c) paper work (d) formalities

- In rural area majority of rich farmers takes loan from

(a) formal sources (b) informal sources

(c) cooperative society (d) self help groups

- A person holding _____________ can easily exchange it for any commodity or service that he or she might want.

(a) Baggage (b) Land (c) Money (d) Eatables

- What a person desires to sell is exactly what the other wishes to buy -

(a) Market (b) Products

(c) Economic activity (d) Double coincidence of wants

- Currency is accepted as a medium of exchange because –

(a) It is easy to carry

(b) Paper doesn't cost's more to be printed in the form of currency

(c) Is authorised by the government of the country

(d) None of the above

- Since the deposits in the bank accounts can be withdrawn on demand, these deposits are called.

(a) Demand deposits (b) Fixed deposits

(c) Commercial deposits (d) Deposits with bank

- A paper instructing the bank to pay a specific amount from the person's account to the person in whose name it has been made -

(a) Demand draft (b) Cheque (c) Pass book (d) Credit card

- Banks in India these days hold about ______ percent of their deposits as cash, as a provision to pay the depositors who might come to withdraw money from the bank on any given day.

(a) 15 (b) 25 (c) 35 (d) 65

- An agreement in which the lender supplies the borrower with money, goods or service in return for the promise of future payment

(a) Saving account (b) Current account (c) Credit (d) Share

- An asset that the borrower owns and uses it as a guarante to a lender until the loan is repaid

(a) Security (b) Guarranty (c) Land (d) Collateral

- Interest rate, collateral and documentation requirement and the mode of repayment together comprise, what is called the

(a) Security papers (b) Terms of credit

(c) Credit (d) All of the above

- The__________supervises the functioning of formal sources of loans.

(a) State Bank of India (b) Central bank of India

(c) Reserve bank of India (d) Finance minister

- 85% of the loans taken by poor households in the urban areas are from -

(a) Co-operatives (b) Local bank

(c) Government bank (d) Informal sources

- In a self help group, most of the important decisions regarding the savings and loan activities are taken by the

(a) Government (b) Group members (c) Group leader (d) Banks

ANSWERS TO EXERCISE – 1

- (b)

- (a)

- (b)

- (a)

- (a)

- (a)

- (c)

- (d)

- (c)

- (a)

- (b)

- (a)

- (c)

- (d)

- (b)

- (c)

- (d)

- (b)

Class 10 Economics Notes Chapter - Money and Credit Exercise– 2

- What is meant by the term 'Barter System'?

- What is paper money?

- "The modern currency is without any use of its own as a commodity." Why is it accepted as money?

- Define a commercial bank.

- Why do lenders ask for collateral while lending?

- What are the differences between formal and informal sources of credit?

- What is called the terms of credit?

- How is the facility of cheque useful?

- What is double coincidence of wants?

- Give main features of commercial bank.

- Explain money as a medium of exchange.

- What is the credit? Why is there a need for credit in rural areas?

- How do banks mediate between those who have surplus money and those who need money?

- In situations with high risks, the credit might create further problems for the borrower. Explain.

- What are the reasons when the banks might not be willing to lend to certain borrowers?

- Discuss functions of a central bank.

- What role do the banks play in the economy of a country?

- In what ways doss the Reserve Bank of India supervise the functioning of banks?

- Explain the loan activities of banks.

- Describe formal and informal financial institutions for saving and credit.

- Why are banks willing to lend to women organized in self help groups?